In reality, as we know it, where coverage is viewed as fundamental, there are minutes when not having protection could really appear to be legit. When Is It Ok Not To Have Overfit? When is it acceptable not to have health insurance overfit? is a question that many individuals face in their lives. Health care coverage overfit alludes to the circumstance where protection plans might unnecessarily cover people, prompting superfluous costs.

Evaluating Your Health Care Coverage Needs

Studying your medical care needs is a huge stage in ensuring that you have adequate consideration for your clinical expenses. Begin by assessing your ongoing wellness status, including any previous circumstances or progressing clinical requirements. Family medical history to determine the level of coverage you may require.

Your monetary circumstance decides the amount you can bear to spend on charges, deductibles, and other personal costs. Your health insurance needs in the future. By cautiously surveying these elements, you can pick a healthcare coverage plan that gives you the inclusion you want at a value you can manage.

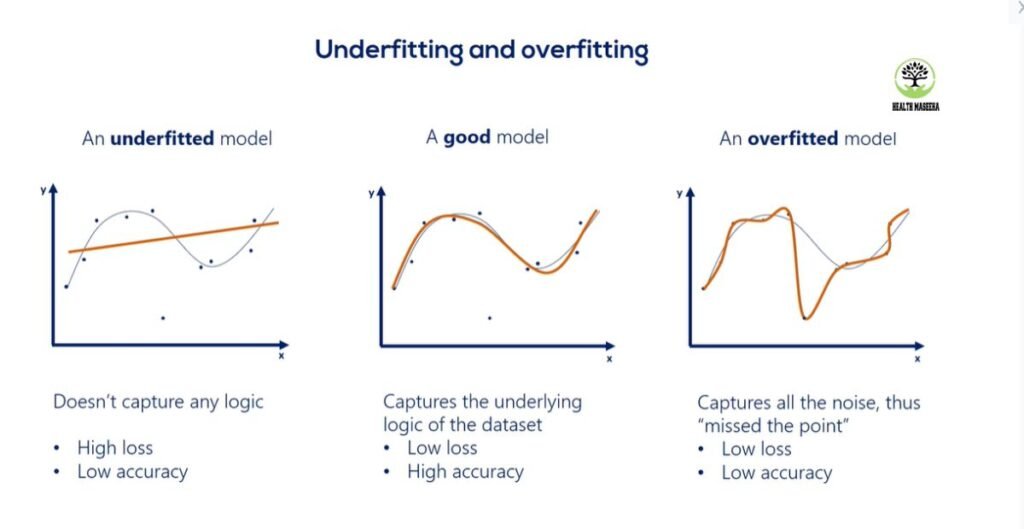

Understanding Health Insurance Overfitting

Health insurance coverage overfitting happens when a policyholder chooses an arrangement with more inclusions or highlights than needed, prompting higher charges and superfluous costs. It’s fundamental to comprehend the particular requirements of you and your family while choosing medical coverage to stay away from overfitting.

On the other hand, on the off chance that you have progressing medical problems or require customary remedies or therapies, a more complete arrangement with higher charges and lower personal expenses might be a superior fit. You can set aside cash while still guaranteeing you have sufficient inclusion for your clinical costs.

Exploring Healthcare Assistance Programs

Medical care helps health insurance programs are intended to assist people and families with restricted pay access to reasonable medical care administrations. These projects shift by area and may incorporate Medicaid, CHIP (Kids’ Health Care Coverage Program), or state-supported medical care help drives.

The Risks of Going Without Health Insurance

Without Health insurance coverage, people are exposed to dangers that can have critical outcomes. One essential gamble is monetary weakness in case of startling clinical costs. Without protection inclusion, people might confront significant bills for medical care administrations, prompting expected obligation or insolvency.

Also, deficiencies concerning protection can hinder people from looking for Health Insurance fundamental clinical considerations, possibly fueling medical problems or prompting undiscovered circumstances. Furthermore, without protection, people might pass up preventive considerations, which can assist with distinguishing medical conditions early and moderate more difficult issues later on.

What Happens Without Health Insurance Overfit?

Also, being deficient with regard can hinder people from looking for fundamental clinical potential fueling medical problems or prompting undiscovered circumstances. This can lead to conditions worsening over time, potentially resulting in more serious Health Insurance complications and higher treatment costs in the long run.

Protection people might wind up troubled with overpowering hospital expenses, prompting monetary strain and even Chapter 11 in outrageous cases. Besides, the absence of preventive consideration and standard check-ups can add to a decrease in overall well-being and prosperity, influencing efficiency and personal satisfaction.

Evaluating the Cost-Benefit of Health Insurance

Health Insurance coverage includes considering different factors, for example, charges, deductibles, and inclusion limits, close to potential medical services needs. While health care coverage can be exorbitant, particularly for those with low wages, it gives monetary assurance against startling clinical costs.

When Is It Acceptable to Forego Health Insurance?

Health Insurance Previous medical coverage might be adequate in specific conditions, even though it conveys intrinsic dangers. For people who are youthful, sound, and have negligible medical services needs, quitting protection could appear to be monetarily judicious, particularly on the off chance that they can stand to pay for clinical costs from cash on hand.

It’s fundamental to think about likely dangers, for example, mishaps or unexpected diseases, which could bring about significant doctor’s visit expenses without protecting inclusion. A few people might meet all requirements for elective medical services choices, for example, government-supported projects or boss-supported well-being plans, which can give inclusion at a lower cost.

Making Informed Decisions About Health Insurance

Picking the right Health Insurance coverage plan requires cautious consideration of different factors like inclusion, expenses, and organization. Begin by evaluating your medical service needs, including any continuous ailments or anticipated therapies. Research different arrangement choices, looking at expenses, deductibles, and personal expenses.

It’s urgent to comprehend the inclusion constraints, including which specialists and emergency clinics are in-network. Furthermore, assess the arrangement’s physician-recommended drug inclusion and any extra advantages like telemedicine administrations. Finally, consider your spending plan and gauge the compromises between month-to-month charges and possible personal costs.

Debunking Common Myths About Health Insurance Overfit

| Myth | Debunking Explanation |

| Health Insurance is Expensive | Health insurance costs vary based on factors like age, location, and coverage level. Many individuals qualify for subsidies or employer-sponsored plans, making it affordable. |

| Healthy People Don’t Need It | Healthcare coverage plans contrast in inclusion, organizations, and expenses. It’s vital to compare plans to find one that meets your medical services needs and accommodates your financial plan. |

| All Plans are the Same | Health care coverage plans contrast in inclusion, organizations, and expenses. It’s vital to compare plans to find one that meets your medical services needs and accommodates your financial plan. |

| I Can’t Get Coverage | Under the Reasonable Consideration Act, safety net providers can’t deny inclusion in light of prior conditions. Furthermore, there are extraordinary enlistment periods and Medicaid for those with low pay. |

| It Covers Everything | Healthcare coverage plans contrast in inclusion, organizations, and expenses. It’s vital to compare plans to find one that meets your medical services needs and accommodates your financial plan. |

One normal legend about Health Insurance coverage is that having inclusion implies all clinical costs are completely covered. As a general rule, most plans accompany deductibles, copayments, and coinsurance, of which you’ll in any case be liable for a part of your medical care costs. Another misguided judgment is that more youthful, better people don’t require medical coverage.

Exploring Alternatives to Traditional Health Insurance Models

While customary Health Insurance coverage plans overwhelm the market, elective models offer inventive ways to deal with medical care. Direct essential consideration (DPC) rehearses offer limitless essential consideration visits for a month-to-month charge, bypassing customary protection for routine consideration.

Well-being-sharing services include a gathering of people who contribute assets to cover each other’s clinical costs, commonly founded on strict or moral convictions. Wellbeing plans, where the organization expects the monetary gamble for representative medical services costs, frequently bring about additional tweaked advantages and cost reserve funds.

Financial Considerations: Balancing the Costs of Health Insurance

While exploring the domain of health care coverage, one of the preeminent worries for people and families is the monetary angle. Offsetting the expenses related to Health Insurance coverage can be an overwhelming errand, thought, and assessment of different elements.

People, first and foremost, should survey their monetary imperatives and monetary abilities. This includes dissecting pay levels, existing costs, and potential medical care needs. Understanding one’s monetary circumstance lays the preparation for making informed choices with health care coverage.

FAQs

What if I’m young and invincible?

Even young adults can face unexpected health issues or accidents, making insurance a wise precaution against financial strain.

When is it okay not to have health insurance?

It might be acceptable if you qualify for government assistance programs or have significant financial constraints.

Is it okay to skip health insurance if I can’t afford it?

Answer: If you genuinely can’t afford insurance, explore low-cost options or government assistance to ensure some level of coverage.

Conclusion

Health Insurance it’s OK not to have medical coverage, it can be a nuanced choice that depends on different elements. Subsequently, finding some kind of harmony between safeguarding oneself from horrendous occasions and keeping away from pointless monetary strain is key in exploring the intricacies of Health Insurance coverage overfit.

Recognizing the evolving landscape of healthcare and insurance options is crucial for making empowered decisions. With the ascent of elective medical services models, for example, direct essential consideration and well-being sharing services, people might track down practical options in contrast to conventional Health Insurance coverage that better suits their necessities and values.